Kevin Drum points to a report in the New York Times that Goldman Sachs is weighing an increase in charitable giving requirements for its senior staff. Kevin poo-poos it:

I think it’s great if corporations support charities or set up charitable foundations of their own. It’s also great if corporations urge their employees to give to charity. But that’s as far as it goes. Charitable giving isn’t a smokescreen for indefensible behavior, and in any case it’s not charity if you’re forced to do it at the point of a gun. Bankers who make millions ought to feel obligated to give some back to the community, but if they don’t, that’s their business, not Goldman’s.

While I think Kevin is definitely right about the limited PR upside here, I think he’s wrong that “it’s not charity if you’re forced to do it at the point of a gun.” That is, I don’t think anyone in need really cares whether or not the food, shelter, or research money or whatever it is that benefits them comes from the end of a gun or not.

Anyway, anyone who hasn’t been lobotomized knows that’s not really Goldman’s objective here, so the debate as to whether Goldman’s charity is valuable irrespective of it’s intent is sort of moot. Rather, Goldman’s play here is much more of an attempt to “self-regulate” before the government, bowing to common sense and popular outrage, does something about an unsustainable situation. To wit, the issue isn’t just that bankers pay themselves obscene amounts of money, it’s that the pay and incentive structure of the banking industry encourages recklessness behavior that endangers the wider economy while providing dubious societal good.

While greater charitable giving requirements would provide some marginal good on the charitable perspective, they wouldn’t do anything to address the incentive problem. Luckily for us — but not as much for banking executive — we already have in a place a system called the “tax code” that can helps push income distribution in a socially beneficial way while also shaping incentive structures.

The situation that Goldman fears are regulations on payment structures that reduce incentives for reckless investment and changes to the tax code that significantly increase the marginal tax rates on the upper extremes of the income spectrum to something closer to our historical norm.

Taken together, these would policies would both limit behavior that endangers the economy and help ensure that at least some of banking profits are funneled into a socially beneficial direction.

Taken together, these would policies would both limit behavior that endangers the economy and help ensure that at least some of banking profits are funneled into a socially beneficial direction.

(By the way, the most likely outcome of this policy is that Goldman just pays even more to account for the difference of the charity requirement. After all, the banking industry has notoriously argued it must maintain absurd bonuses to preserve its talent. If Goldman starts lowering its real compensation levels, how can it retain talent?)

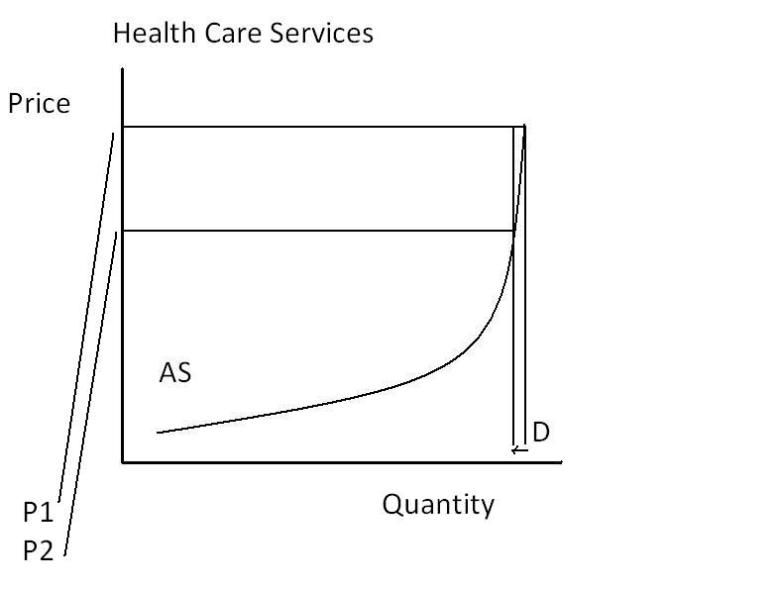

Demand for medical services is basically inelastic. That is, when we are sick, we will continue to consume health care services until we die, run out of treatments, or run out of money (there are exceptions, but generally, our desire for self-preservation is fairly limitless). This is true for all health systems: France, UK, Canada, you name it. The difference is that in the United States, we allow the free market to determine price, and since the United States is incredibly wealthy, this pushes demand to the limit of supply, driving the price of medical care with it. Of course, bargaining through large insurance pools — as happens in the employer and public markets — helps contain growth, but the trend still remains.

Demand for medical services is basically inelastic. That is, when we are sick, we will continue to consume health care services until we die, run out of treatments, or run out of money (there are exceptions, but generally, our desire for self-preservation is fairly limitless). This is true for all health systems: France, UK, Canada, you name it. The difference is that in the United States, we allow the free market to determine price, and since the United States is incredibly wealthy, this pushes demand to the limit of supply, driving the price of medical care with it. Of course, bargaining through large insurance pools — as happens in the employer and public markets — helps contain growth, but the trend still remains. Health care reform, if it’s expected to be sustainable, rests on reducing demand for health care services. In the UK or Canada, this is accomplished through strict government rationing. In other places, it’s accomplished through risk pooling and bargaining (I’ll add this and hard-cap rationing aren’t mutually exclusive). The problem isn’t in the theory, it’s in the politics. In the United States, reducing demand for health care services will hurt the bottom lines of pharmaceutical companies, private insurance companies, and of course, doctors, nurses, and hospitals. And these are powerful people.

Health care reform, if it’s expected to be sustainable, rests on reducing demand for health care services. In the UK or Canada, this is accomplished through strict government rationing. In other places, it’s accomplished through risk pooling and bargaining (I’ll add this and hard-cap rationing aren’t mutually exclusive). The problem isn’t in the theory, it’s in the politics. In the United States, reducing demand for health care services will hurt the bottom lines of pharmaceutical companies, private insurance companies, and of course, doctors, nurses, and hospitals. And these are powerful people.

Posen and Hinterschweiger’s dry, academic take:

Posen and Hinterschweiger’s dry, academic take: